Accountants, Bitcoin and Blockchain Industry: Aligned by Ethical Principles

The accounting profession and blockchain industry membership prioritise transparency, integrity, accountability, trust and innovation, making them aligned in their core ethical values and principles

Introduction

I decided to join Blockchain Australia after finding that its Members' Code of Ethical Conduct resonates well with my professional accounting ethics.

As a Fellow member of the Institute of Public Accountants (IPA), one of three professional accounting bodies recognised in Australian legislation alongside the Chartered Accountants Australia and New Zealand (CA ANZ) and CPA Australia, I am bound to abide by principles of professional ethics contain in the IPA’s By-laws and APES 110 Code of Ethics for Professional Accountants.

As a Registered Tax Practitioner, I must also observe a set of ethical standards under the TASA’s Code of Professional Conduct (the Code).

Having operated a professional accounting practice for more than 15 years, I recently pivoted my practice to focus on Bitcoin and blockchain business and accounting. Electrafi (previously Electra Frost Advisory and Accounting) has now become a member of Blockchain Australia, firming up our commitment to the sector.

Comparing the Accounting and Blockchain Realms

Many accountants are sceptical about crypto and what this space represents. It might at first seem like we’re comparing apples and oranges, but we aren’t.

Bear with me here!

They stand in juxtaposition: the trusted domain of accounting and the disruptive Bitcoin and blockchain movement. While accounting is anchored in time-tested traditions and ethical norms, the emerging Bitcoin and blockchain industries represent the forefront of technological evolution …along with unknowns and risk.

However, a closer examination of ethical principles reveals a harmonious alignment, suggesting potential for collaboration and mutual advocacy.

The Time-Honoured Ethical Pillars of Accounting

Accounting and tax practitioners have long been the sentinels of financial truth. Our profession is anchored to a stringent set of ethical standards:

Integrity: At the heart of our profession lies the principle of integrity. Accountants are expected to be straightforward and honest, ensuring that stakeholders can trust the financial narratives presented to them.

Objectivity: Accountants and tax practitioners must not allow bias, conflict of interest, or undue influence to override their professional or business judgments.

Professional Competence: Tax laws and finance are ever-evolving. To navigate all the complexities, continual professional development ensures that practitioners maintain the knowledge and skills necessary to provide competent services.

The Ethical Tenets of Bitcoin and Blockchain

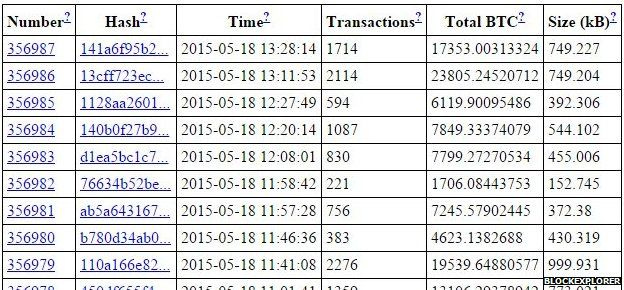

Transparency fosters trust - The Bitcoin Blockchain can be inspected by anyone

Bitcoin, a pioneering peer-to-peer payment system, promotes transparency, decentralisation, and individual empowerment. It exists on a decentralised network of computers with blockchain for an unalterable and public ledger of transactions.

Transparency and Trust: Bitcoin, through its decentralised and distributed nature, promotes transparency. This aligns with a fundamental pillar of conduct in the accounting profession to provide open and honest disclosure of financial information. Much like Bitcoin's blockchain is lauded for its security and trustworthiness, members of our accounting bodies are often regarded as the most trusted professionals.

Irreversibility and Integrity: Bitcoin transactions are irreversible, solidifying economic contracts and turning code into economic law. This mirrors the integrity that accountants must uphold in their practices.

Incorruptibility and Fairness: The use of Bitcoin contributes to ethics by restoring transparency and preventing fraud, leading to a fairer and more incorruptible society. Accountants, too, are bound by their professional ethics to ensure fairness in their financial representations and play a crucial role in protecting society from corruption and fraud.

Ethical Design and Responsibility: Just as Bitcoin's pioneering architecture set a precedent for transparency and decentralisation, it has influenced the ethical design principles of subsequent blockchain and AI technologies. This resonates with the responsibility accountants have in holding Professional Practice Certificates and developing Quality Assurance Manuals.

Blockchain Australia, in bringing the best and brightest in the industry together in the shift to a digital economy, upholds a Code of Ethical Conduct emphasising reputation, compliance and respect for established standards. We see reflected in this Code very similar ethical standards that apply to professional accountants.

Blockchain Australia’s Ethical Code for Members

Blockchain Australia's Member Code, binding upon all its member organisations, lays out a comprehensive set of ethical principles:

Reputation: In an industry as nascent as blockchain, reputation is everything. Members are urged to ensure their actions cast the entire blockchain industry in a positive light.

Respect for Rules: The blockchain industry might be new, but it's not the Wild West. Adherence to all applicable laws, regulations, and industry standards is non-negotiable.

Honesty, Privacy and Confidentiality: These three pillars echo the ethos of the accounting profession. Members must act with honesty in all their business dealings, protect personal information and safeguard information with adequate systems and processes to maintain confidentiality and prevent its misuse.

Fairness, Respect, and Responsibility: Treating all individuals with fairness, taking responsibility for one's actions, and ensuring accountability are key tenets that align closely with accountants’ obligations to act impartially.

Competency and Self-Improvement: Just as accountants are committed to continual learning, Blockchain Australia members are encouraged to perpetually hone their skills and knowledge and be appropriately accredited for their roles.

Conflicts of Interest: Members must ensure that they identify and manage any conflicts of interest that could compromise the integrity or objectivity of their professional conduct.

Responsibility for Actions: Taking responsibility for one's actions and ensuring accountability is a key principle of the code.

The Ethical Confluence

When we compare the ethical frameworks of these domains, a confluence emerges:

Integrity and Honesty: Both the accounting profession and Blockchain Australia prioritise unwavering honesty and straightforwardness in their operations.

Professionalism and Competence : There is a shared commitment to continual professional development, competency, best practices and adherence to standards.

Accountability: Whether it's an accountant safeguarding financial data or a blockchain professional ensuring a transparent and immutable record of transactions, accountability is paramount.

Let’s Get Together!

The worlds of accounting and blockchain, though seemingly disparate, are bound by shared ethical commitments. This presents a zeitgeist opportunity for collaboration between our industries. Accountants, with their reputation for trustworthiness and expertise, are uniquely positioned to lead and advocate for the blockchain revolution starting within their practices from the moment they start learning about it.

By applying for Professional Membership with Blockchain Australia, accountants can get informed and involved. It’s a first step to help to shape the future of finance and good policy, ensuring transparency, accountability, and empowerment for all.

I value my industry peers’ thoughts on this.